AfCFTA could unleash opportunities in many sectors, such as transport and logistics. (Image source: Adobe Stock)

Moin Siddiqi, economist, discusses the opportunities and challenges arising from the African Continental Free Trade Area (AfCFTA) agreement

The African Union (AU) flagship project, the African Continental Free Trade Area (AfCFTA) agreement connects 1.4bn people across 55 countries in a US$3.4 trillion economic bloc. It envisages vastly increased ‘intracontinental’ trade in goods and services by dismantling rigid trade barriers, strengthening efficiency in customs, leveraging digitalisation and most importantly, closing the region’s infrastructure gaps.

“Creating a single, continent-wide market for goods and services, business and investment would reshape African economies. The implementation of AfCFTA would be a huge step forward for Africa, demonstrating to the world that it is emerging as a leader on the global trade agenda,” said Caroline Freund, global director of trade, investment and competitiveness, World Bank.

The African continent has capacity to achieve 7-10% growth by taking advantage of its population to grow a robust single market, as China and India have done.

“Building a single market will enable Africa to position itself among the three largest global marketplaces,” said renowned US economist Prof Jeffrey Sachs. AfCFTA goals can unleash opportunities in transport, logistics, energy, ITC, and banking services (trade finance).

Comprehensive charter

The scope of AfCFTA is ambitious: progressively eliminate tariffs and nontariff barriers (NTBs) on goods; enhance trade facilitation and address technical barriers to trade (TBTs); liberalise trade in services and boost competitiveness; encourage intra-Africa and foreign direct investments; and develop regional and continental value chains.

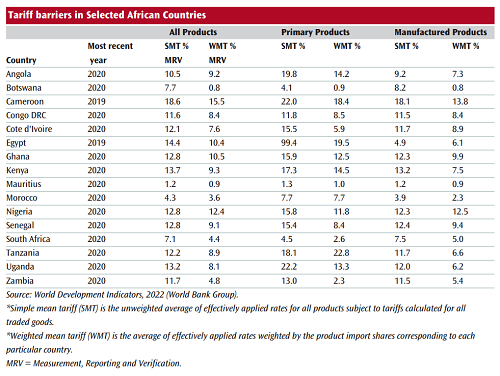

Member states are phasing out 90% of tariff lines (i.e., items listed in a country’s tariff schedule) within 5-10 years, while 7% (deemed sensitive) are given an additional period and 3% are placed on an exclusion list (see box on p18). Thus far, 80% of AU countries have submitted their tariff reduction schedules. The signatories will benefit from reduced tariffs, hence lower prices of imported goods for consumers and producers using intermediate inputs.

NTBs impose onerous regulations (red tape) like strict technical and phytosanitary standards, higher quotas and trading licenses that raise compliance cost. The average trade-weighted NTBs for goods and services in Africa amount to 30% (World Bank data). Thus, reducing NTBs benefits consumers of final (household) and intermediate goods (firms). Large cuts in tariffs and NTBs could increase merchandise trade flows between signatories and real per-capita GDP by 15% and 1.25%, respectively, or more if supported by an efficient trade environment, according to the International Monetary Fund (IMF).

AfCFTA also seeks to improve trade facilitation (hard/soft infrastructure) at borders and along corridors between countries. Optimising the AfCFTA framework requires accepting Niamey Declaration “to leverage trade facilitation among AU members to promote efficient and increased trade flows across the continent.”

Overall, with lower trade costs, the unit price of imports falls, which boosts competitiveness of local production (using imported inputs). Concurrently, production shifts to the most competitive sectors, thereby resulting in higher productivity gains and faster economic growth. Trade facilitation to remove operational constraints yields the largest gains. However, differences across countries depend on the initial level of tariffs, NTBs, and border costs. Reducing tariffs are an easier task, but dismantling NTBs is time-consuming.

In addition, AfCFTA’s protocols aim to unify eight regional economic communities (RECs) with overlapping memberships into one market based on the European Union (EU) model, as well as addressing marginal impact of existing subregional preferential trade agreements (PTAs) by harmonising rules on competition policy, investment protection, intellectual property rights and tax administration, as well as dispute resolution mechanisms. This, in turn, will create a single legal framework for the continent to facilitate intratrade and investment.