By Victor MUJIDU

M-KOPA, a leading African fintech platform, today announced the official launch of its flexible digital financing model in Ghana following a successful pilot phase.

The strategic move to expand its operations makes Ghana the second West African country for the company, strengthening its Pan-African footprint to provide financial and digital inclusion for underbanked customers.

The company established its market entry in the Greater Accra Region, focusing on smartphone financing.

Leveraging key partnerships with Samsung and Nokia, M-KOPA has provided financing to over 100,000 people and unlocked more than $10m in digital credit for customers in Ghana. These early-stage milestones pave the way for future regional growth and product expansion.

Mayur Patel, M-KOPA’s Chief Commercial Officer, said: “As a truly inclusive fintech on a mission to improve financial and digital accessibility, Ghana presents an exciting opportunity for us to expand our impact.

Our customer-centric approach will enable us to enhance the day-to-day quality of people’s lives. We are thrilled by the success of the first phase of our entry in Ghana and are on track to serve more customers across the country”.

The Ghana launch follows the recent publishing of M-KOPA’s 2023 Impact Report, which shares the company’s remarkable progress in servicing over 3 million customers and unlocking over $1bn in credit.

Nearly half of all M-KOPA’s customers are first-time smartphone users, and 4 out of 5 customers report the quality of their lives has improved because of M-KOPA’s innovative products and services.

Chioma Agogo, General Manager, M-KOPA Ghana, said: “We are incredibly proud to announce the official launch of our successful operations in Ghana. This move represents a pivotal step in M-KOPA’s journey to inclusion and underscores our tangible impact and commitment to empowering the customers we serve in Ghana.”

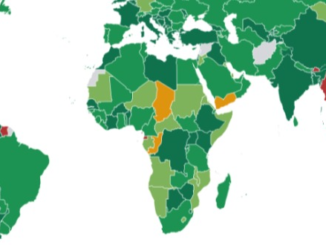

M-KOPA’s fintech platform has steadily grown its footprint in Kenya, Uganda, Nigeria, and Ghana, with plans to expand to South Africa.

The innovative company combines the power of digital micropayments with the Internet of Things (IoT) to provide customers with access to productive assets. In markets where individuals have limited pre-existing financial identities and conventional collateral, M-KOPA’s flexible credit model allows individuals to pay a small deposit and get instant access to everyday essentials, including smartphones, and to digital financial services such as loans and health insurance.